- Business finances for dummies full#

- Business finances for dummies pro#

- Business finances for dummies software#

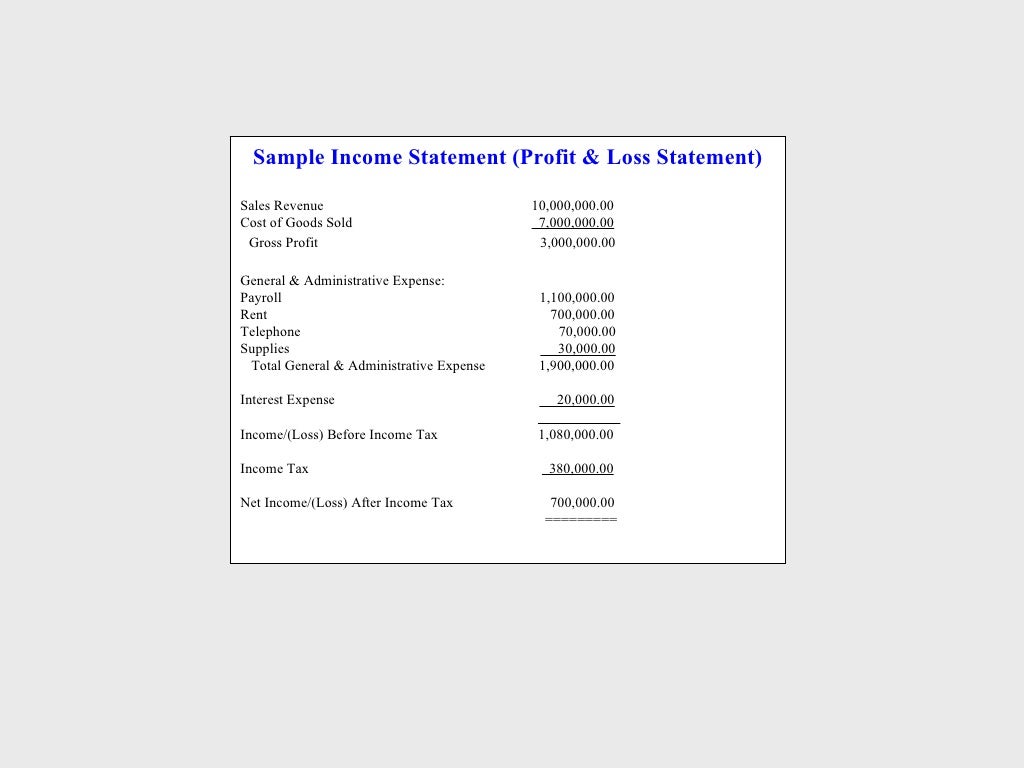

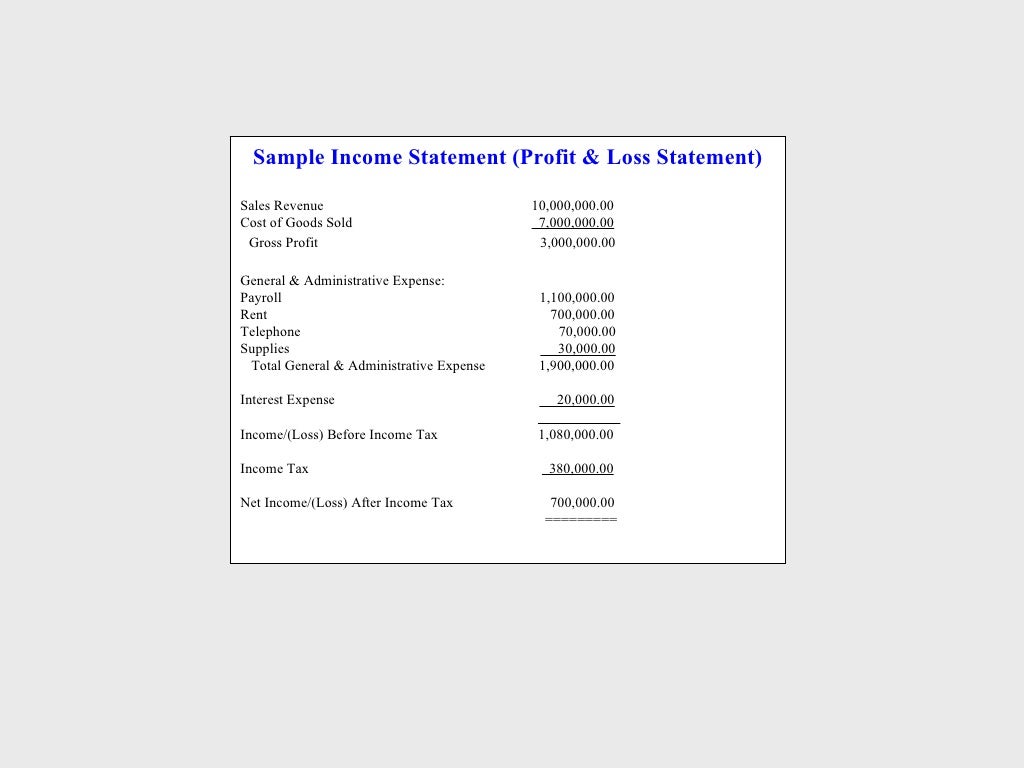

Cash Flow Statements fill in income statements’ gaps because they outline the tangible cash that your business currently has in its possession. While you begin to master small business finances, make maintaining a clean and concise income statement a priority. This tool is also what you will use to report to the government.

FTEs, or Full-Time Equivalents (employees)Īs you begin to monitor these various numbers, it is important to remember that the income statement is what any investor, accountant, or business mentor will want to see first. The number of sales/subscribers /active users/$ Annual Recurring Revenue (ARR) or Monthly Recurring Revenue (MRR). These metrics give you information on all of your transactions and intel on your company’s growth. There are several key performance indicators (KPIs) to monitor as you use your income statement. Your income statement can be healthy, showing revenue coming in, but you are not able to collect it. However, this tool does not give you enough information to accurately assess your business’ profit, as it works on an accrual basis. This formula is revenue – expenses = profit. Income Statements, or a profit and loss (P&L) statement, use a basic formula to calculate your company’s profit. Learning the Financial Basics As you begin to learn the basics of what goes into your small business finances, there are three critical tools you should understand.

When these tools are used well, small business owners can achieve financial success and take control of their small business finances. There are unique characteristics that your company brings to the table that should be considered!

A great template, the tool that allows you to apply basic financial concepts to your small business and its current state. Research skills that allow you to evaluate the current market and take into account how your competitors are operating. A mental map of your business, a road map that gives you direction when analyzing your financial projections and setting long-term goals. Finance basics, the simple concepts behind each step of your small business financing process. As you work to streamline your small business finances, there are several tools you can use to simplify the process. Don’t forget to follow BizHack on Facebook, Twitter, LinkedIn and subscribe to our YouTube channel. Want more of these great insights? Subscribe to our community newsletter and get invited to #BizHackLive events. Business finances for dummies full#

These methods allow you to stay organized and have a full understanding of your small business’ finances. Leverage well-organized financial templates as you do your own bookkeeping.

While there are ways to pay off money that you owe, at the end of the day, any money you spend paying off debt is money that you didn’t invest in your business.

Monitor your company’s debt and try your best to avoid accumulating debt. These tools allow you to stay on top of your small business finances and help you leverage your financial projections. Master financial tools and templates like income statements, cash flow statements, and a balance sheet. But, as a small business owner, it is important for you to at least understand what goes into your small business finances. TL DR: 3 Tips To Start Streamlining Your Small Business Finances Many business owners hire accountants to do the numbers simply because they find them complicated or just downright confusing. Business finances for dummies software#

To learn how you can implement these methods and software into your business’s financial planning, keep reading.

Business finances for dummies pro#

During a #BizHackLive webinar, Mike Lingle, founder of Rocket Pro Forma and an expert in financial projections for startups, encouraged small business owners to use a variety of financial tools when planning their small business finances. Financial projections give small business owners a glimpse into the future. Almost all small businesses can use bookkeeping software or accountants to their advantage when considering past financial success and shortcomings. To conduct successful small business finances, professionals need to take past numbers into account while balancing their company’s future strategy. However, there are basic tools and concepts that can be easily leveraged by professionals running a small business.

As a small business owner, you do not need to be a financial expert to manage your company’s funds. 3 Effective Tips for Streamlining Small Business Finances Simple, yet efficient small business finances are the foundation to any successful business model.

0 kommentar(er)

0 kommentar(er)